Irene Zhong’s International Approach to Proprietary Costs

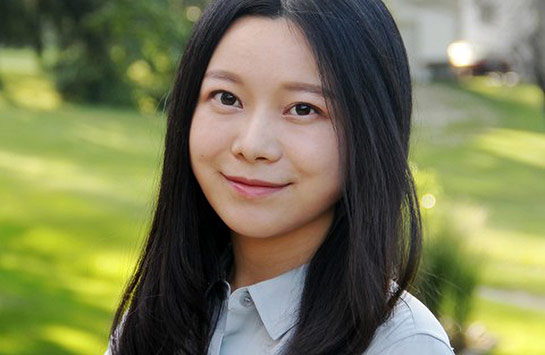

Irene Zhong's International Approach to Proprietary Costs

“In the context of innovation, an organization’s transparency is a double-edged sword,” says Professor Irene Zhong, who recently obtained her PhD in accounting from the University of Missouri at Columbia. “Of course, transparency can be good. Reducing information asymmetry makes it easier to court investors, so in this sense, transparency benefits the research and development phase of innovation, which is heavily reliant on external equity financing.”

But firms in this position should avoid too much of a good thing.

“If a firm shares too much, the value of their intellectual property can decline, and this is a cost of transparency, a cost that may be greater or lesser depending on the strength of the property rights protections wherever the firm is operating. This is what we call the ‘proprietary costs’ problem.”

Looking at proprietary costs in different countries is part of the international approach Zhong takes to her work. “It’s crucial that accountants have a global mindset. I push students to consider how globalization affects accounting in many countries, not just the U.S. For example, how do the International Financial Reporting Standards impact different countries with different histories, cultures and regulations?”

In addition to her research at the University of Missouri, Zhong spent six years at a leading commercial bank in China. Why did she come to UIC? “At a time when Chicago is growing as an international finance center, UIC Business is growing. The breadth of faculty interests makes for an exciting community, and the diversity of the student body stimulates my work in international accounting.”